The Small Business Owner’s Guide to VAT (Value-Added Tax)

Understanding how VAT tax works for your small business can be a minefield.

You’ll need to get to grips with Corporation Tax, National Insurance Contributions (NICs) and personal Income Tax – including Dividend Tax if that’s how you pay yourself – when you’re setting up your operation.

You must also keep a keen eye on alterations to the taxation system that seem to come about every few months – from changes to the taxable income threshold to the recently confirmed NICs increase.

Amid the constant din of fiscal policy announcements, one type of tax often gets overlooked: Value-Added Tax (VAT).

VAT in the UK is nearly 50 years old. It’s levied as part of the total price that consumers and business customers pay for goods and services provided by all VAT-registered firms in the UK (and some outside it). The ‘sales tax’, as it’s also called, is the third-largest source of UK Government revenue.

For small business owners, VAT-related crucial issues to consider include:

- Whether to register

- How to register

- What to charge and when

- Submitting VAT returns

In this guide, Cashflow Manager provides an overview of the tax, why it might be right for your organisation, and the ins and outs of registering for, and managing VAT at your firm. We hope it adds value to your tax knowledge.

1. Why and when to register

Just under half – 48%, or 2.7 million – of all UK-based SMEs were registered for VAT or PAYE in 2021 according to the Federation of Small Businesses.

These figures could be very different but for two major myths surrounding VAT registration that are worth considering:

Myth #1 – All firms charge VAT

There is a widespread perception that all businesses registered in the UK must add VAT to their prices – but this isn’t true.

In fact, businesses are legally required to register for VAT only if their annual turnover during the previous 12 months, or the forthcoming 30 days, is greater than the VAT threshold.

The threshold currently sits at £85,000, having most recently been reviewed in July 2020.

It’s also important to know that VAT applies to all types of small businesses – limited companies, sole traders or partnerships. There are no exceptions.

Myth #2 – Earning below the threshold means you can’t register your firm for VAT

No, this isn’t true either. You can still voluntarily register your organisation for VAT even if your earnings don’t reach the threshold.

You might be asking, why bother? There are actually several reasons why it could still be a good option:

- There can be a financial advantage to registering for VAT and joining the ‘flat rate scheme’. For example, you pay less VAT back to HMRC than is collected on your invoices (you keep the difference).

- Registering helps to recoup some start-up costs. For example, the VAT element of your initial budget spent on buying equipment can be reclaimed and become part of your cash flow again.

- Your customers are unlikely to be affected if they are VAT-registered – most of the time they can reclaim the added cost of buying goods or services from you.

- Being VAT registered can lend authority and a feeling of permanence to your operation. It also means customers won’t know if your revenues are lower than the threshold unless you tell them!

Just remember – it’s vital to remember that you can only charge VAT if your business is VAT registered. Otherwise, it’s not something you can add to your pricing or invoices.

2. How to register for VAT?

Most businesses aiming to register for VAT now find it easiest to do so online.

You can do this yourself on the UK Government portal, which is designed to deal with everything related to VAT registration – you can find it here.

This is the easiest way to register. You may also sign up for an online VAT account.

HMRC will require specific information to set you up for VAT, including:

- NI number or Unique Tax Reference

- Business activity from the past two years

- Bank details

- Turnover figure(s)

Once you’ve completed the registration process, which is relatively quick and straightforward, you’ll receive a VAT registration certificate soon afterwards – normally within 30 working days. This confirms:

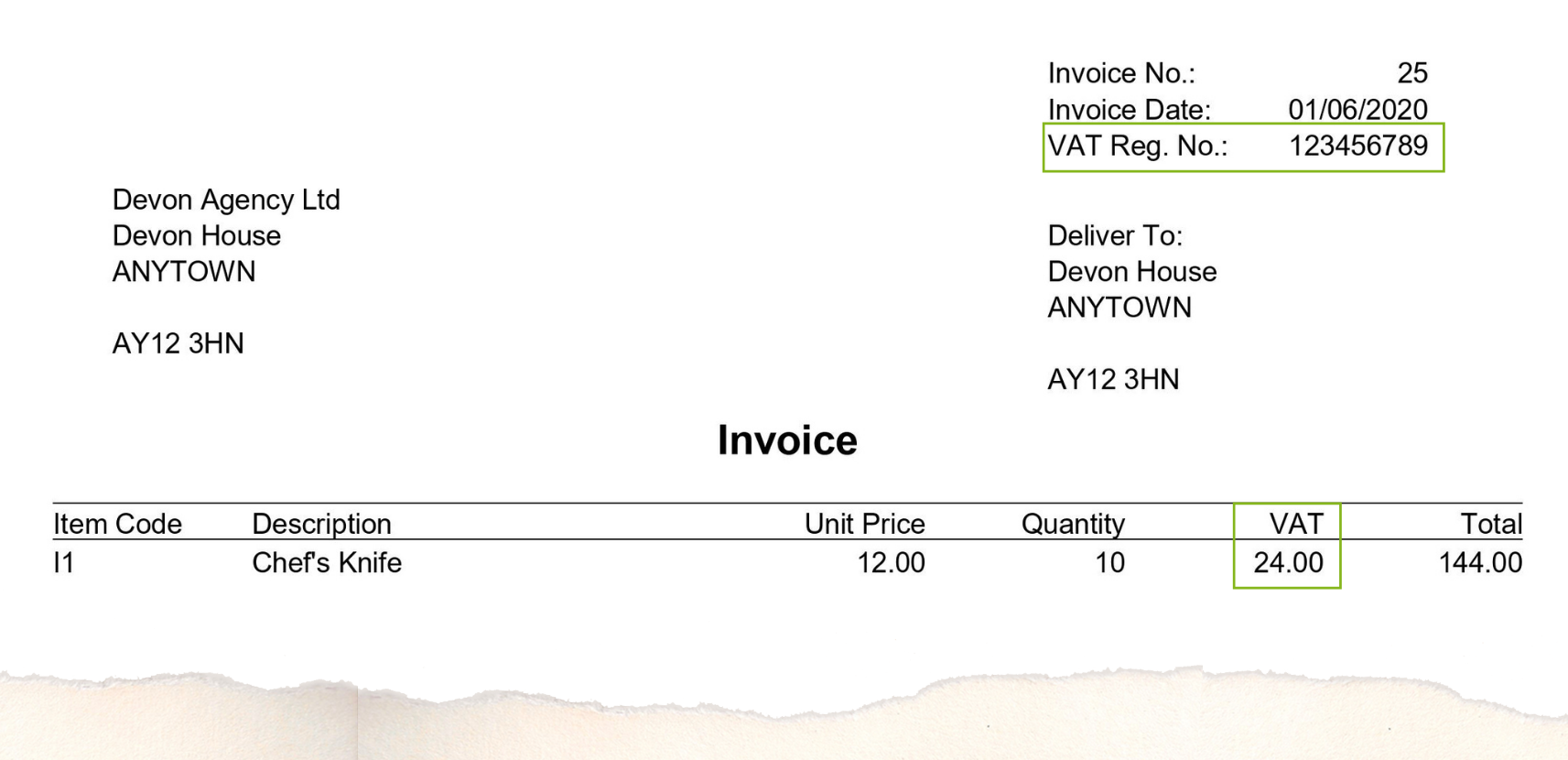

- your company’s VAT number, which you should include on all invoices sent to your customers

- details of when to submit your first VAT return and payment

- your ‘effective date of registration’, whether or not you registered while surpassing the VAT threshold.

Keep your VAT registration certificate in a safe place in case you need to refer to it later. In fact, it’s a good idea to keep a separate paper or electronic file of all your VAT-related correspondence or other documentation).

Good to know

It’s also fine for an accountant (or agent) to register for VAT, deal with HMRC and submit returns on your behalf.

- Note that all businesses were required to register for Making Tax Digital by April 2022: more details can be found in Section 4 and also on the Government’s tax portal.

- You are not allowed to charge or show VAT on invoices until your official VAT number arrives – but you will still have to pay the VAT to HMRC for the period in question.

One way around this is to increase your prices temporarily to include the difference, and inform your customers why you’re doing so for a brief period. Once you have received your VAT registration number you can reissue your invoices showing the VAT cost.

- It’s possible to receive a fine for late registration if you fail to make VAT payments that you’re liable for, based on registration rules (as set out in Myth #1 above).

If you register late, you must pay what you owe from when you should have registered. Failure to do so could land you with a penalty, depending on how much you owe and how late your registration is.

3. Calculating and charging VAT

It’s vital that your business charges customers the correct amount of VAT. This can be tricky, as there are three different rates to choose from:

- Standard rate – most goods and services are currently charged at 20% VAT, and you should add this rate to your prices unless your goods and services are classed as reduced or zero-rated (as follows).

- Reduced rate – you’ll charge this rate depending on the item in question and the sale circumstances. For example, utility bills generally carry a VAT tariff of 5%.

- Zero-rated – these goods and services are still VAT-able and need to be recorded in accounts and on VAT returns, but you must charge customers 0%. Some examples include books and newspapers, and items to be exported outside the UK.

You can discover more about reduced and zero-rated items on the Government’s VAT portal.

4. Time to send an invoice including VAT

You’re registered and you’re ready to send an invoice that includes your cost for VAT.

Taking note of the correct rate to charge, as mentioned above, is imperative. Here are two other things to consider:

- VAT-inclusive and exclusive prices: You’ll need to make a calculation when charging VAT on goods or services, or when working out the amount of VAT you can claim back on items which were sold inclusive of VAT.

- VAT-inclusive prices: To work out a price including the standard rate of VAT (20%), multiply the price excluding VAT by 1.2. To work out a price including the reduced rate of VAT (5%), multiply the price excluding VAT by 1.05.

- VAT-exclusive prices: To work out a price excluding the standard rate of VAT (20%) divide the price including VAT by 1.2. To work out a price excluding the reduced rate of VAT (5%) divide the price including VAT by 1.05.

- It’s worth being aware that if you invoice a business that isn’t VAT registered you will have to swallow the cost of the VAT. This may happen if you have a small business customer; it can also be an issue if one of your subcontractors in the supply chain isn’t VAT registered.

At this point it is worth having an honest discussion about the need to raise your fee beyond your normal rate to ensure VAT charges are covered and you aren’t left out of pocket.

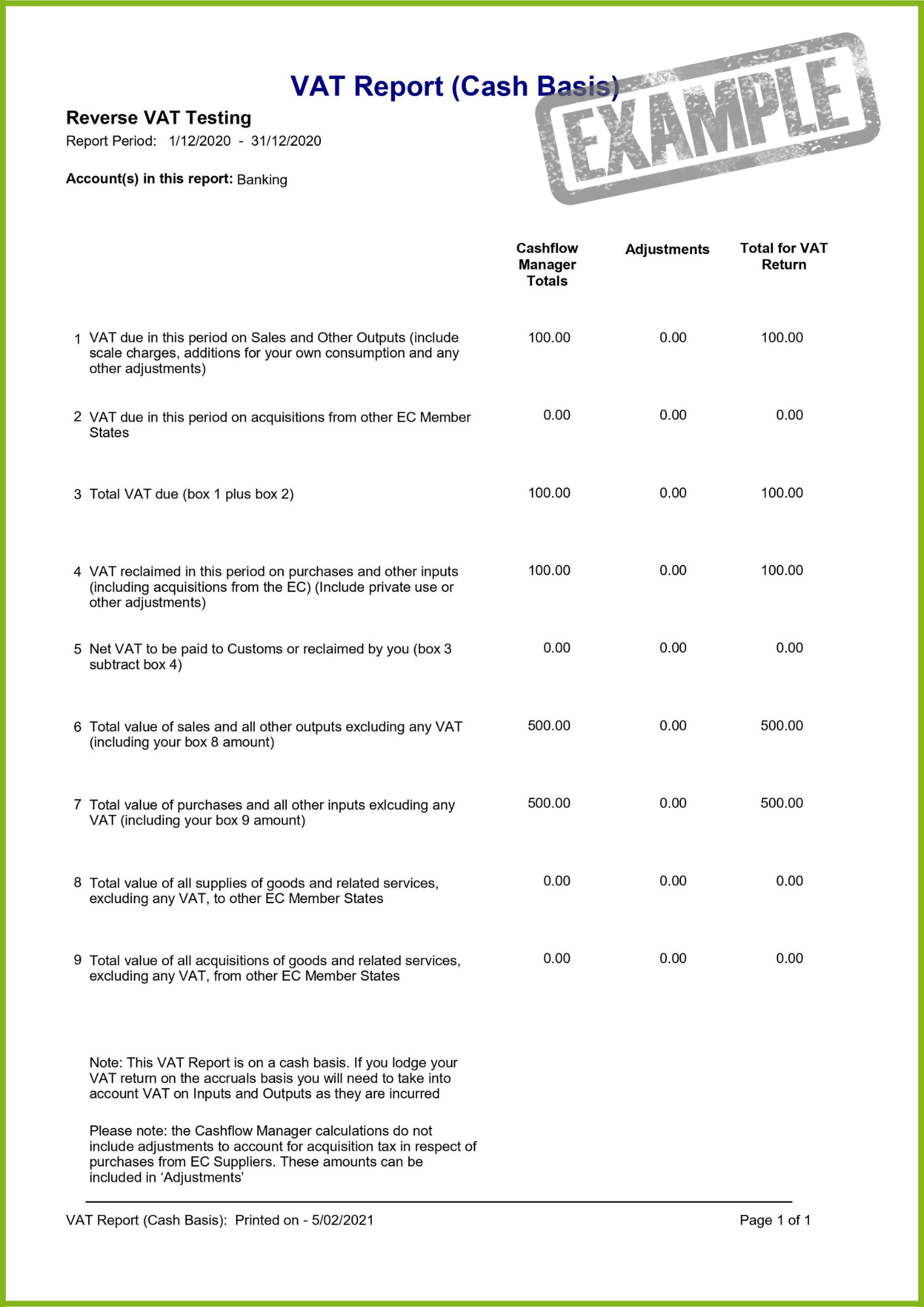

5. How to pay – submitting VAT returns

Once your business is registered, you’ll gain access to the part of the UK Government website that will let you complete your VAT returns. This is where the VAT you’ve charged is declared to HMRC.

The tax year is generally split into quarters, meaning that you’ll need to log on to the website four times per year to submit an online VAT return (or your accountant/agent can do this for you).

The VAT return is a summary of your earnings – including the VAT you’ve charged for your goods and services – plus your expenses, which includes the VAT you’ve paid for goods and services. The difference between these amounts will determine how much you need to pay or claim in your quarterly VAT return.

If you prefer, you can apply to HMRC for dispensation to submit only one annual VAT return. This entails making fixed monthly payments to account for VAT that’s due, and is normally an option taken to help with cash flow and budgeting.

Whichever time period you choose for submitting your VAT Return, Cashflow Manager takes the pain out of the process. Simply navigate to Reports and click ‘VAT Report’. Punch in the relevant dates (whether that’s the year, quarter or month) and Cashflow Manager will prepare your VAT Return in seconds. If you’re registered for MTD (spoiler: you probably should be!) then you can even lodge your VAT Return from within Cashflow Manager.

Making Tax Digital for VAT

If you’ve registered for Making Tax Digital (MTD) for VAT – which all VAT registered businesses need to do by April 2022, as mentioned in Section 2 – the records you must keep are the same as any VAT-registered business.

The main extra responsibility is a requirement to keep your records digitally. For specific details of records that must be kept digitally for MTD-registered businesses, visit the Government’s VAT portal. Cashflow Manager is a registered MTD for VAT-enabled solution.

In summary, you’ll need to:

- keep records of sales and purchases

- keep a separate summary of VAT (called a VAT account)

- issue correct VAT invoices

The records must be kept for at least six years.

Wrapping up VAT advice

We hope you now have enough information to decide whether you must (or might) sign up for VAT, and that we’ve covered any concerns you have about registering for and paying this form of business tax.

Cashflow Manager offers simple, record-keeping software that is perfect for small VAT-registered businesses. Did you know that most accounting solutions are filled with unnecessary, complicated add-ons that most small businesses never need or want?

Cashflow Manager keeps things simple so that you can focus on running your business. Try Cashflow Manager today to easily:

- Submit VAT returns

- View submitted returns

- Check what VAT you owe

- View VAT payment history

Try Cashflow Manager, free for 30 days. No credit card required

Leave a Reply