Getting Paid On Time As A Small Business

As a sole trader or small business owner, you’ve probably received a late payment at some stage and suffered cashflow problems because of it. But, not only are late payments a nuisance, they’re quite common. A recent study found an estimated 20% of small businesses have run into cash flow problems because of them.

So, how can you protect your business in a culture of late payments, especially when the impacts of COVID-19 are still present? Read on for our tips on how to get paid on time.

1. How do I invoice properly?

Having a good invoice template will save you a lot of time in the long run. Did you know there are minimum requirements that you must include on every invoice? These include:

- A unique identification number

- Your company name, address and contact information. If you’re a sole trader or limited company, be sure to include the full company name as it appears on the certificate of incorporation

- The company name and address of the customer you’re invoicing

- A clear description of what the invoice is for

- Date the goods or service were provided (supply date)

- The invoice date

- The amount(s) being charged

- VAT amount, if applicable

- The total amount owed

Other details you can include are:

- The name of your contact – preferably from your Finance department

- Their agreed purchase order or internal customer reference number

- Clear payment terms, and a warning that interest and compensation will be charged on late payments

2. How many days do clients have to pay an invoice?

Unless you agree to a payment date, the customer has 30 days from receiving the goods or service to pay you. Any longer than 30 days, and it becomes an overdue invoice. To incentivise clients to pay sooner (either an early or upfront payment), you could try to offer discounts as a reward. Before engaging in work, be sure to set your own payment terms, and make sure they are clear to the customer.

3. Can I charge interest and compensation for outstanding payments?

Yes, you can. It doesn’t matter if the invoice was for £20 or £20,000.As a business owner, you have the right to charge interest and compensation for late payments from other businesses. This protection is under the Late Payment of Commercial Debts Act 1998 and applies to businesses, not consumers.

To determine how much interest should you charge, the Small Business Commission has an easy to use Interest & Compensation Calculator, alongside details of what to include on the invoice. As an example, an invoice of £550 that is 19 days overdue would incur an interest charge of £2.12, and £40 as compensation -so £42.12 in total.

To pursue any interest charges or compensation owed, you will need to produce a new invoice. Although it isn’t legally required, it’s best to make sure that your original invoices always include the relevant wording.

4. I have an invoice that needs to be paid. What do I do?

The first step is to double check the invoice: are the contact details correct? Did you provide correct payment details? Was it issued properly? Remember, re-invoicing will start the clock again, so it’s a good idea to speak with your customer first to try and resolve things without extending the payment time.

Then, assuming everything is correct, it’s reasonable to chase things up. Not everyone is comfortable doing this, but if you can chat with someone in your client’s accounts department, it will likely be easier – these will be routine calls for them.

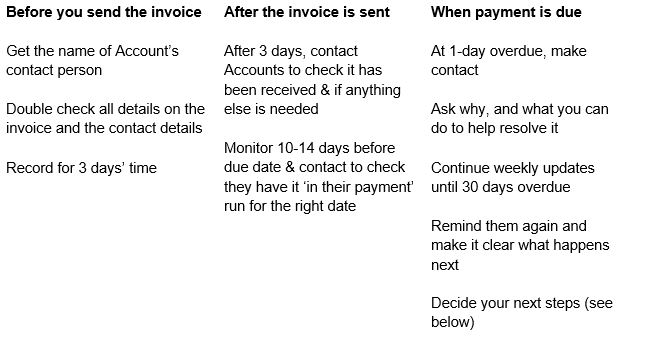

Having a process in place will surely make your life easier. For example:

5. How do I escalate an overdue payment (after 30 days)?

Once you’ve reached the 30-day mark, it’s time to act. If you’re unsure on what your options are, the Small Business Commissioner(SBC) has advice on the various ways to escalate overdue payments to help you choose the option that best suits you.

You can also read more about the Prompt Payment Code set up by the SBC, and its success so far in changing the way many companies pay their suppliers. You can also see who has signed up to the code, which is always useful if you end up dealing with them.

Leave a Reply