Knowledge Base: Your Cashflow Manager Help Centre

You spoke, we listened, and now we would like to introduce you to Knowledge Base, our online Cashflow Manager Help Centre.

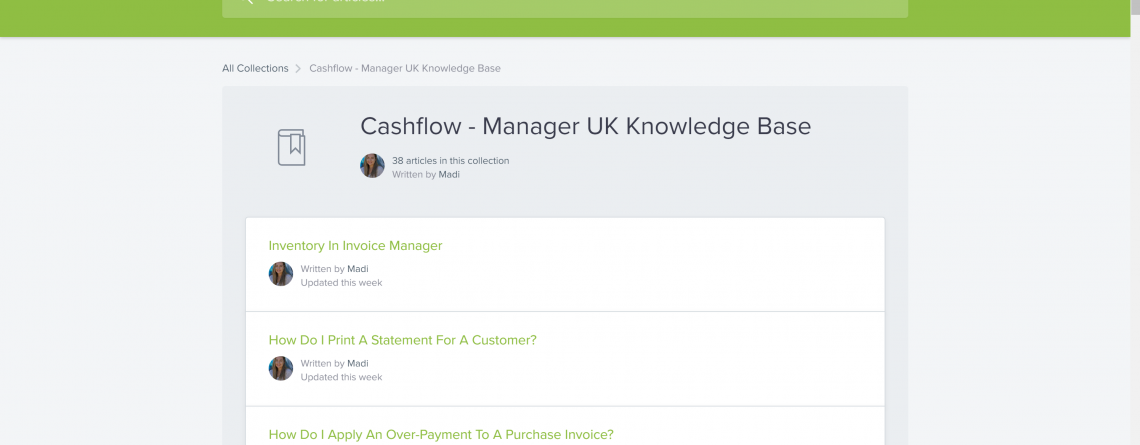

This centralised hub, which you can access direct from the support tab on the Cashflow Manager website, gives you instant access to helpful information on all Cashflow products, from installing the latest software update to handy hints and tips for setting up and using Invoice Manager.

Knowledge Base is updated regularly with new information direct from our Customer Experience team and is driven by real-life challenges customers are experiencing today, making it an invaluable resource on those occasions when you need a helping hand to get the most out of a feature or troubleshooting.

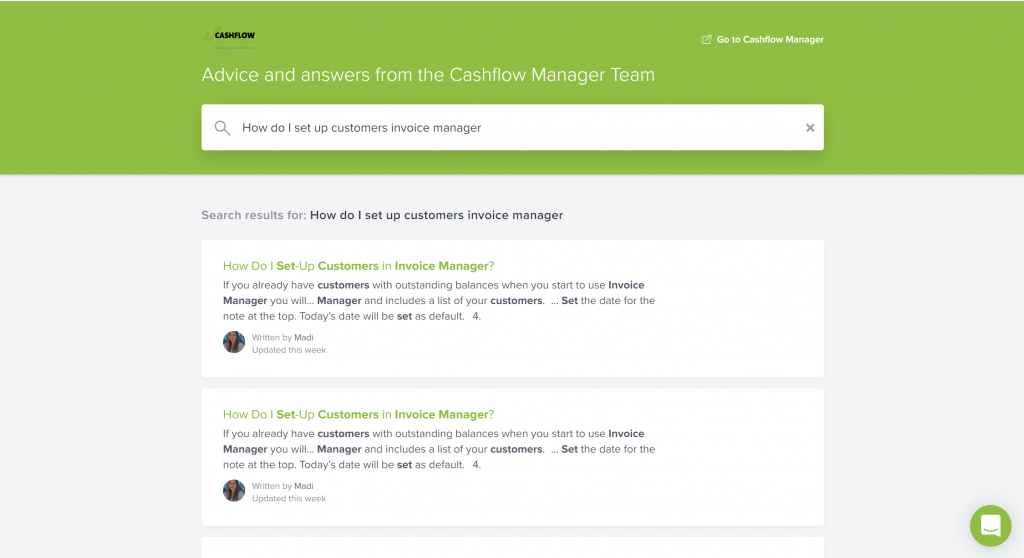

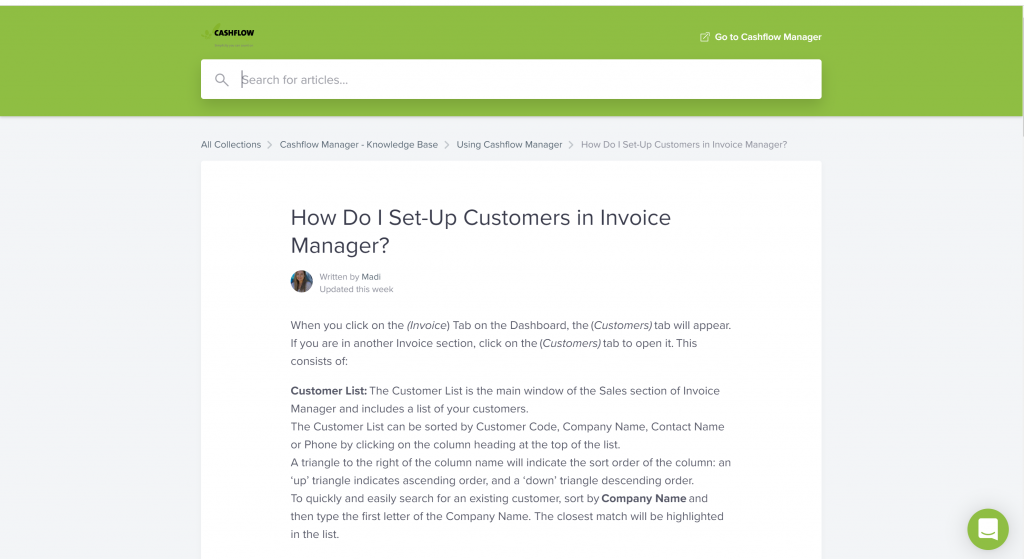

Knowledge Base is completely searchable making it easy for you to find the information that you need fast. Simply click on the spyglass icon at the top of the page and enter your search query, for example <How do I set up a customer in Invoice Manager>, press return and all results relevant to your search query will be displayed.

You can then click on the most relevant article to your search query and get the answer or help you require.

The great thing about Knowledge Base is that it is continuously updated with all of the latest hints, tips and tricks on how to get the best from your Cashflow product, so when you need answers fast Knowledge Base should be your first stop.

We are always looking for ways to improve your Cashflow Manager experience, so if you have any feedback on Knowledge Base let us know in the comments below.

Comments (20)

When I completed my quarterly VAT return at the end of June, 2019, and sent it digitally to HM Customs and Excise at the press of a button (after finding it difficult to work out what to do as requested for numbers etc – not clear at all), there was no confirmation as far as I could see to show me that HM Customs had received my submission. Previously when I completed the return and sent it to them directly online I was given this confirmation and also told the date that the amount owed would be collected from our bank account. It was only when I contacted HM Customs on another VAT matter that I was able to check with them that the return had been received successfully and was given an approximate date when the amount would be taken by Direct Debit. They said it was the responsibility of our software provider to provide this information. Does Cashflow Manager show this and if so where should I look – if not please look into providing this as it is our responsibility to make payments and we need to know for certain that our return has been received by HM Customs. It is also useful to know when they will take the money owing.

Hi Alison,

If a VAT submission is successful, a message pops up and says “VAT successfully submitted. Would you like to view your VAT Bill Payment options?”. If the user responds with a ‘Yes’ to the message, you are automatically guided to the bill payment options, where you can make payment. I will send you an email with the guide on this process.

Why am I unable to access my cashflow11. Sometimes it works the message I am receiving is ‘unable to validate your subscription. Please try and open the programme later which is really frustrating

Hi Catherine, This message means can happen if you have low or poor internet connection. If you get this message again, try switching off the internet and going into the program when it is off.

Hi whilst trying to submit my VAT return for the period 1/7/19-30/9/19 the message ERROR 403 keeps app;earing .

Please advise as to how this can be rectified.

Hi Patrick, The organisation or entity have not used the correct user ID or password details for the authorisation process, or they have not subscribed correctly to the VAT MTD pilot.

The HMRC VAT Online Services Helpdesk have the correct functionality to assist with when these errors occur.

Hello, I’m new to cash flow manager. When filling in the money in & out the Vat at 20% is not deducted correctly. It carries the full amount across to the VAT cells as well. For example enter £100. Vat shows at 16% and it carries through at £100. Is this correct? Do I need to adjust settings at all?

Hi Ken, that is correct. The Money In and Out include VAT. When you run the reports it will remove it. If you want to chnage any VAT settings, go to Tools in the top left.

I’m trying to enter my accounts for January 2021 and when I try and change the year on the money in screen it says ” outside of ‘year’ parameters. What does this mean please ??

Hi Suzanne, please download the latest update to v11 from here: https://www.cashflowmanager.co.uk/downloads/

When trying to send our vat return, we keep getting the message “your token is not valid”

What does that mean?

Hi Mo, please give our Customer Engagement Team a call to resolve this on 0345 1300611 between 8.30am- 12.30pm

Hi Maddi,

Trying to lodge my VAT return, and error message “ Your access token to communicate with HMRC is not valid”

keeps popping up, any help would be greatly appreciated.

Thanks

Mike

Hi Mike, please give us a call on 0345 1300 611 and we can help you with this.

I’m trying to enter my info January 2021 and when I try and change the year on the money in screen it says outside of ‘year’ parameters. I’m on version 11.

Hi Cheryl, please download the latest update from the downloads section. Once that has installed, you can move into 2021

I’m trying to enter my info January 2021 and when I try and change the year on the money in screen it says outside of ‘year’ parameters. I’m on version 11.

I see a reply to update version, where so I find this?

Hi Ashley, you can download the update from the Support then Software Downloads section of the website.

Hi,

I have recently bought a new laptop, and downloaded my version of Cashflow manager, on to it

And like before, when I downloaded an updated version, I cant print up any reports or invoices, as its not recognising the printer on the printer box.

I’ve been looking on the site, and I’m sure I’ve seen a heading, trouble printing reports, after updating, but cant see it now

Hi Philip, you will need to set your printer as the default printer from the settings section of your laptop. If you go to settings on the laptop and then to devices, under printers and scanners, you can select your printer and set it as the default. You can then print your reports in Cashflow Manager.